(SOURCE: AppMagic) The first half of 2023 is officially over, and it’s a great time to look back at what happened on the market and make predictions for the second half of the year. Our last market report was a 2022 Mobile Review, where we highlighted the gaming genres that defied the market’s decrease and hence were exciting to explore and discuss. We compared the success rate of different subgenres – the number of launched titles that went over $50k/month relative to all games released in that subgenre in 2022.

Similar to last time, we’re going solely focus on the performance of the mobile games market in Tier-1 West countries, which include Australia, Canada, France, Germany, the UK, and the US.

Also, this report’s main focus is on the Casual Games market, but you can check out our Q1 or Q2 Hypercasual games market review to have a more comprehensive view of mobile gaming.

Back in January when we did our Annual Review, these casual games subgenres caught our attention thanks to great performance and higher-than-average success rate:

- Merge-2 games with 6% success rate and 100% YoY revenue growth

- Match-3 Tile games with 2.2% success rate and 85% YoY revenue growth

- Idle Tycoon games with 4.2% success rate and 30% YoY revenue growth

- Farming games with 1.8% success rate and 11% YoY revenue growth

- Survival Arena with 3% success rate. The genre came into existence in 2022, so there’s no way to calculate the growth rate.

In contrast, the whole casual games market in 2022 was 0,29%, so everything above that is considered great.

And today we’re going to revisit these (and some other) subgenres to see if they’re holding up to the expectations we had 6 months ago.

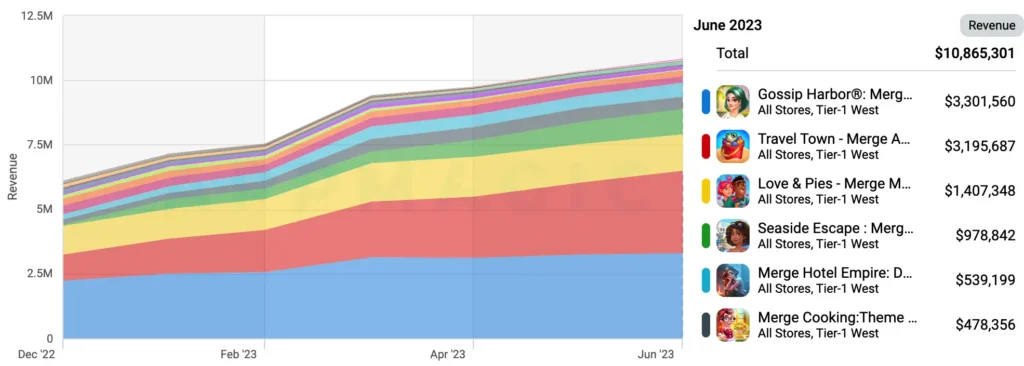

Merge-2 Games

In our “Merge Genre Breakdown” report from last year, we concluded: “…all future successful descendants of Merge Mansion and Love&Pies will employ the L&P’s order system, as it provides no disadvantages and multiple advantages.”

And that’s exactly what happened: all the 10 highly successful Merge-2 titles released in 2022 utilize the order system initially popularized by L&P. That’s why we’re going to talk about this particular subgenre.

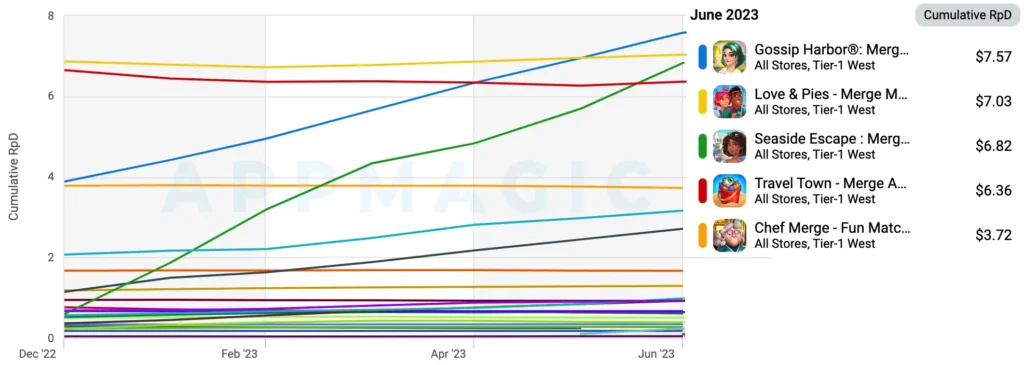

The market keeps growing, and its monthly revenue went up 60% in H1’23, which is insane considering the mobile gaming market landscape:

Although the poster child of this genre is definitely Love&Pies, this time we want to highlight the amazing job Microfun Limited did, putting out two hugely successful Merge-2 games in a row. First, Gossip Harbor, which recently overtook Love&Pies in RpD numbers, and now Seaside Escape, which is about to be the second-highest-grossing title on the market. Microfun’s secret sauce is a dense in-game events schedule, a high level of payment offers personalization, sprinkled with their vast experience in UA. They basically combine their market knowledge and understanding, with best practices from the top-grossing titles.

Out of 44 titles that came out in 2023, none managed to achieve success (>$50k/month) in Tier-1 West countries. The market is getting even more competitive.

The only new successful game that can be attributed to 2023 is Merge Cooking which started scaling back in December 2022. The title embraced the cooking setting, adding a new twist to the Merge-2 formula. It was done by introducing new generators that you have to combine with other pre-merged items, thus reminding the cooking process.

Obviously, you can speed up the process by purchasing local currency. Also, worth noting is a multi-layered monetization system with 4 different paid passes, premium currency, etc. Though it’s not necessarily good for the game, since sometimes it feels overwhelming.

Despite the market’s growth, it seems like Live Ops and profitable UA campaigns can lead to success, rather than innovations and experimentation. But we’ll have a better understanding of that in another 6 months.

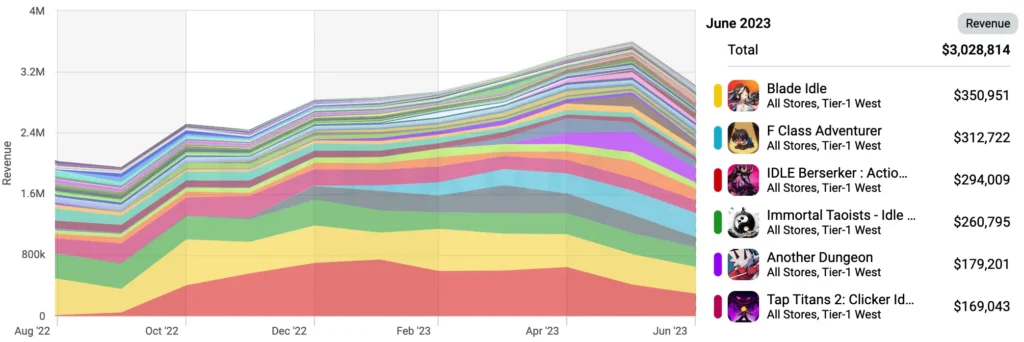

Idle RPG

One of the genres we didn’t cover in our annual report since the market’s growth was just starting to be visible back then.

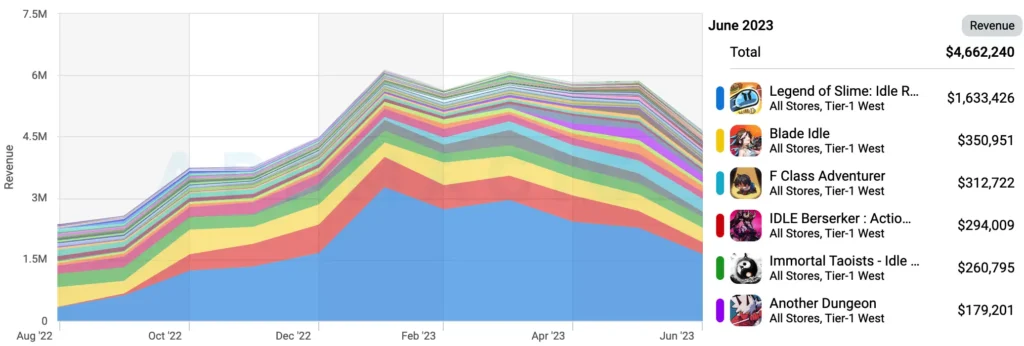

Over the last 6 months though, the market went up around 20% in monthly revenue all thanks to numerous new titles that came out in 2023. Yet the biggest and most talked about is definitely Legend of Slime which combines a deceptively simple core gameplay loop with surprisingly deep and complex meta and monetization tricks.

But even if we take Legend of Slime out of the equation, the market’s outlook is still fairly positive with multiple newly released games driving the growth. Out of 154 titles released in 2023, four passed the $50k/month mark, bringing the success rate to 2.6%.

Surprisingly, the majority of successful titles were published by South Korean companies, so perhaps Seoul is turning into an Idle RPG capital of the gaming world.

The popularity of this genre among developers can be explained by a relatively low production cost with high potential returns. So we see a blast of new titles coming out every day with hopes to get a slice of the pie. And in that, it is very similar to another genre we covered extensively (and mentioned in our annual report) – Idle Tycoon games.

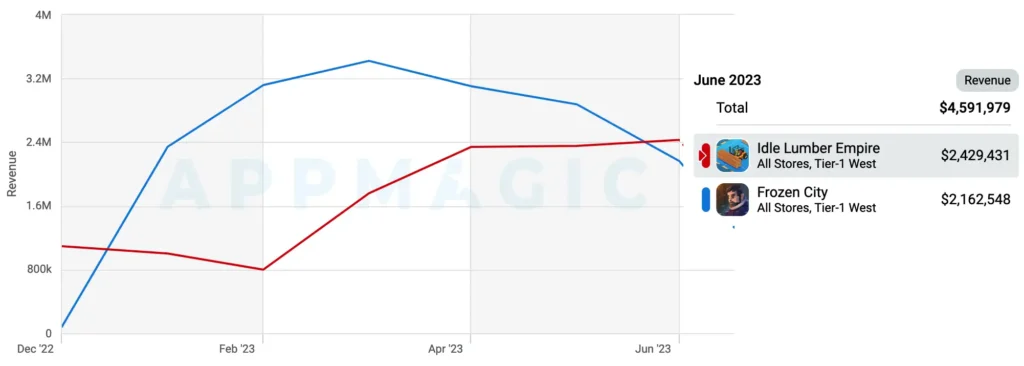

Idle Tycoon games

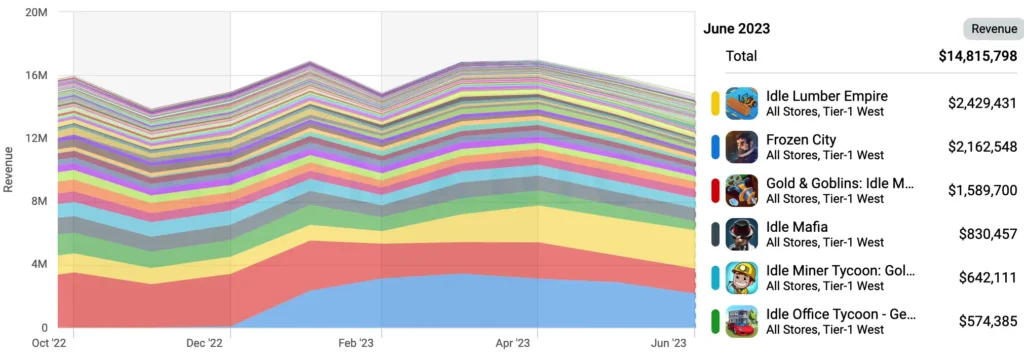

The market’s performance is nothing to write home about – the monthly revenue barely moved since December’22, and out of 190 titles launched in 2023, only one managed to cross the $50k/month line, which is 0.5% success rate.

Yet, there’s still something to mention here – Frozen City and Idle Lumber Empire. The former is another breakout hit from Century Games, this time an Idle Tycoon game combining RPG, survival, gacha, and, well, idle mechanics. It’s also worth noting that a lot of these elements were heavily inspired by PC/Console title Frostpunk, which is anything but casual. The game was on everyone’s radar in the first weeks of 2023 right when it blew up and started scaling aggressively. But even now, 6 months later it is the second highest-grossing Idle Tycoon game out there. Fun fact, Century Games also put out a 4x Strategy Whiteout Survival with the same setting and art style and even used the same ad creatives, which ultimately helped them scale to the current $18M/month.

Yet the biggest game on the market is … a 2021 title Idle Lumber Empire which surprisingly caught a second wind in February 2023, tripling its revenues and downloads in a matter of months. And besides being updated just a few days before the growth started, the game also started doing much more in the UA department, significantly ramping up the number of ad creatives they use.

It’s obviously a more mature market than Idle RPG games, so you don’t see crazy growth or high success rate. Instead, it seems like smart UA and Live-Ops strategy bring the most result.

Match-3 Tile Games

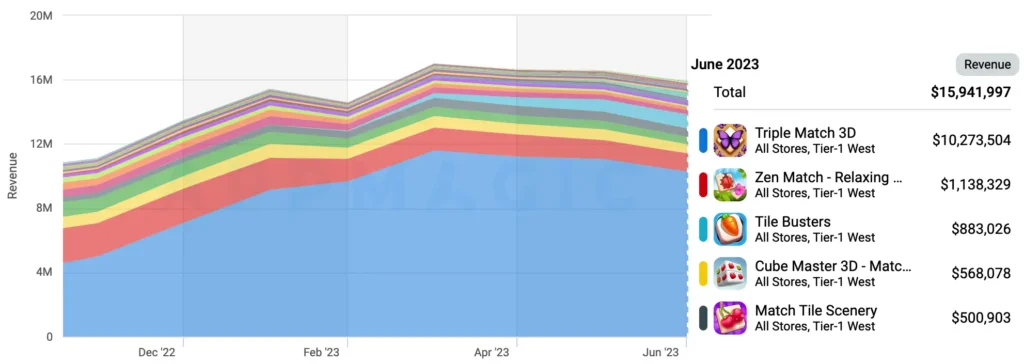

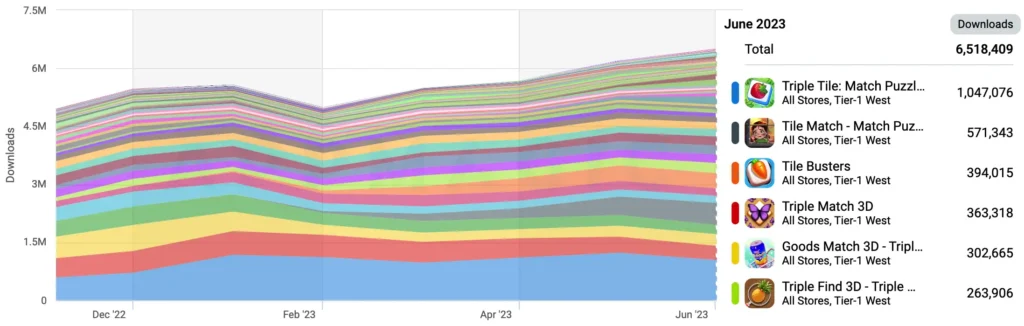

I know everyone’s dying to know how Triple Match 3D is doing. Well, the title kept growing for the first months of 2023, going up 50% in monthly revenue since we last visited it back in December’22, just wow. But take Triple Match out of the picture, and you’ll see that the market actually scaled back a little, and Zen Match was the biggest culprit of that.

One notable release here is Spyke Game’s Tile Busters which combines the core gameplay loop of Zen Match sprinkling it with Coin Master’s meta on top. And it works for engagement and monetization, respectively.

Also, worth noting here – the downloads are still going up, and recently reached an all-time high, meaning ad monetization is very important for the genre, and there’s still an audience to try and scale further.

Over the whole year of 2022, we saw 280 releases, with 2.2% success rate. And in the last six months of 2023, the number of releases jumped to 203 titles and success rate plummeted to 0.4%, with Happy Match Cafe: ASMR being the only successful release.

The market is getting more and more competitive, with big players (Moon Active, Spyke Games, Boombox Games) tightening their grip on it.

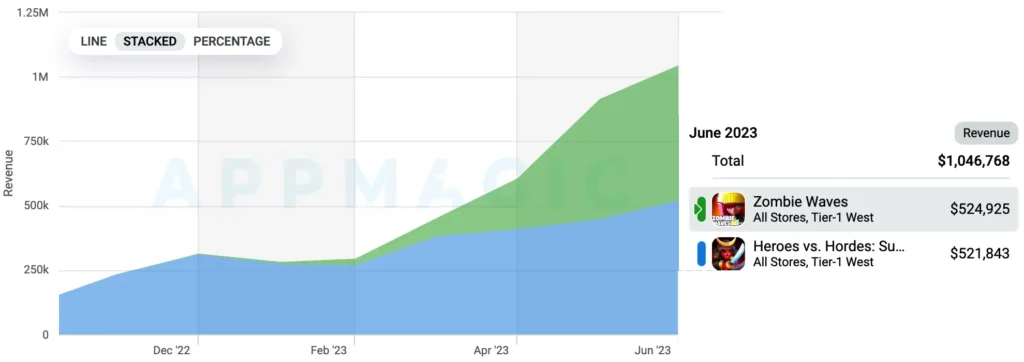

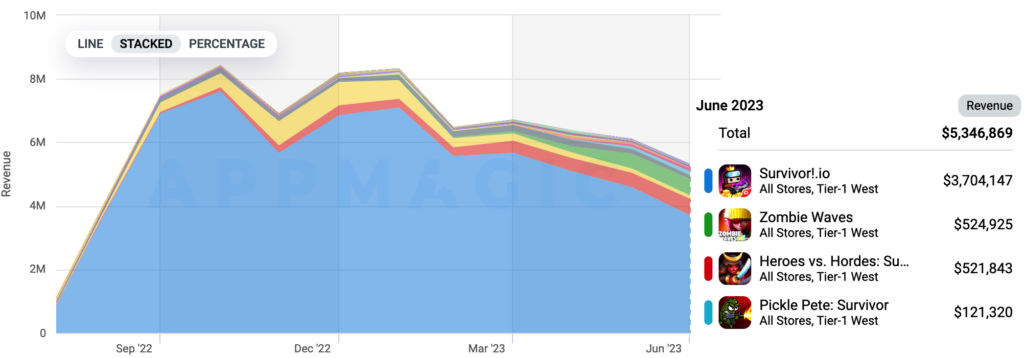

Survival Arena

This list wouldn’t be complete without Habby’s masterpiece – Survivor.io. Even today the game holds up well if that’s what you call making $3M+ a month:

One fun fact about Survivor.io’s competitors – a lot of them were actually launched before Survivor.io, perhaps inspired by Vampire Survivors. But once Survivor.io came out, the majority of them saw the insane value having meta gameplay has, so they worked on adding it to their titles. But besides that, there are not a lot of games that we want to mention. In fact, there are only two of them – Zombie Waves and Pickle Pete.

The developers are still launching new projects at an insane rate – 258 in the last 6 months (compare to 80 on the Match-3 market). So naturally we see success rates plummeting from 3% in 2022 down to 0.8% in H1’23 – the market simply can’t take these many titles. Out of 258 Survival titles launched, only these two can be called successful.

Honorable mentions

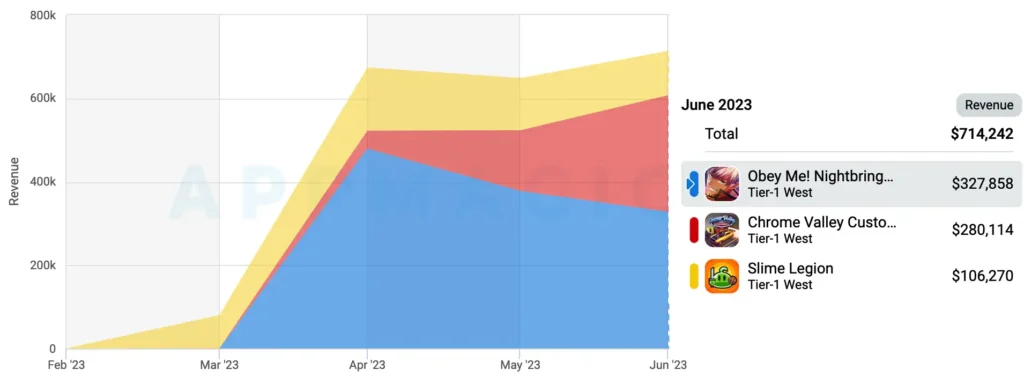

And a few titles we wanted to mention for being the three biggest Casual titles released so far this year:

- Chrome Valley Customs – one of the most successful Match-3 titles since Royal Match. The game’s basically Project Makeover for the male audience – match-3 puzzle core gameplay (great match-3 engine) with a car restoration/makeover meta layer. Certainly bold, although the game’s RpD is too low to be competing with the Royal Matches of this world.

- Obey Me! Nightbringer – the epitome of an anime-stylized storytelling game with fairly simple gameplay, tons of dialogue, and a pretty complex storyline that goes on for hours.

- Slime Legion – another successful title with ‘Slime’ in its name (Legend of Slime being the first one) is riddled with countless meta layers and endlessly difficult core puzzle gameplay. With the game’s level of complexity and weirdness, it reminds us a lot of Random Dice. Besides, Asian markets drive the majority of revenue for both titles. And we all know that Rush Royale tweaked Random Dice’s formula to be more appealing for the Western markets, so perhaps this might work with Slime Legion.

Key Takeaways

The market certainly slowed down in terms of growth, but the publishers keep numerous new projects, which results in low success rates.

The approach we’ve been standing by at AppMagic is looking for ‘Hidden Gem Markets’ – fewer attempts,and higher success rates. This approach can help developers find promising new markets with less competition thus getting more chances to succeed.

We’re even developing a dedicated tool that will make looking for markets like this an easy task. But even now, with the help of Market Segment Comparison and Advanced Search, you can start digging for some hidden gems. If you’re interested in learning more about either our approach or our tools that can help you find hidden gems don’t hesitate to contact us!